David J. Dykeman, Co-chair, Global Life Sciences & Medical Technology Group, Greenberg Traurig LLP 07.30.19

Bringing innovative medical technology to market today is as complex and competitive as it’s ever been for entrepreneurs and startups. One of the major hurdles for any early-stage medtech company is funding product development, and the venture capital sector has grown increasingly cautious.

According to a MoneyTree report from PricewaterhouseCoopers and CB Insights, venture capital (VC) firms invested more than $2.9 billion in medical device companies in 2018, a slight increase from the $2.8 billion raised in 2017. Despite the modest uptick, the bar for new investments has been raised. Many VCs are waiting to invest until a device achieves sufficient safety and efficacy evidence, or until regulatory approval and reimbursement have been secured. In fact, over the last two years, 78 percent of medtech VC investment has gone to later stage deals (Series B+), with many companies raising commercialization rounds after FDA approval.1 In 2018, ophthalmology and neurology devices each had four VC deals valued over $150 million. The neurology deals were Series D or later, and six of the eight deals were commercial stage.1

Faced with this financing challenge, early-stage medtech companies need to get creative and cast their nets widely for new sources of funding. Non-VC sources of financing are gaining popularity and providing medtech entrepreneurs with more choices than previously available.

Seed Investments Can Help Launch a Startup

Seed investment from angel investors, incubators, and accelerators can help startups move from an idea to proof of concept, and in the process, begin to de-risk the technology. Seed investment can reduce the amount future investors might need to invest to move new products through FDA approval and commercialization. Seed stage investment often takes the form of convertible notes or interest-bearing loans.

Seek Non-Dilutive Funding

Non-dilutive funding includes grants, awards, prizes, or contracts that do not require giving up any equity in the company. Sources of non-dilutive funding include the government, nonprofit entities, or charitable foundations.

Government Grants: Various federal government agencies award grants and/or contracts to support medtech research and development, including the National Institutes of Health, National Science Foundation, Department of Defense, and Department of Energy. Some grants are awarded for groundbreaking science, while many federally funded research grants are directed toward specific diseases, organs, or stages of life. State agencies often give grants to companies located in economic development zones or that move to the state. One challenge with government grants is that startups need capital quickly, while government grant cycles move slowly, often taking six to 12 months.2

America’s Seed Fund: The Small Business Innovation Research Program (SBIR) and the Small Business Technology Transfer Program (STTR), known as “America’s Seed Fund,” are the world’s largest source of non-dilutive, early-stage seed capital. Nearly 5,000 small businesses receive more than $2.5 billion in U.S. federal government grants and contracts to help them conduct the R&D needed to develop and bring high-tech products to market through the SBIR. Sponsored by various government agencies, SBIR grants can help bridge the period between the end of federally funded research and early-stage investment from angel or seed investors. SBIR eligibility requirements are straightforward—the business must be for-profit, have less than 500 employees, be independently owned, located principally in the U.S., and the principal researcher must be a company employee.

Disease Foundations: Nonprofit disease foundations harness the collective power of the public, private, and academic sectors, fostering collaborations and serving as incubators. Disease foundations can move rapidly and have the flexibility to fund high-risk pilot studies outside the industry roadmap. Disease foundations can inspire follow-on funding from the government, incentivize larger companies to partner sooner, and engage experts with extensive experience in the regulatory process to create a well-defined strategy toward FDA approval. Disease foundations can provide philanthropic support for additional clinical trials and data collection to ensure that FDA-approved treatment options are covered by insurance companies and become broadly available to patients. The investment is also non-dilutive, since foundations typically do not take equity in the startup.

Increased Corporate VC Interest

The last decade has seen a dramatic rise in large medtech and life science companies creating venture funds to invest in promising early-stage medical technologies that align with industry giants. These company-based investment funds have stepped in to fill the funding gap and help early-stage medtech companies cross the valley of death. In the last few years, large medical companies have been competing in the race to acquire private medical device companies in the neurological, surgical, orthopedic, and cardiovascular spaces.

Some recent examples of strategic investments by major players in early-stage companies include:

In addition to traditional sectors such as cardiovascular and orthopedics, medtech investments are being driven by new technologies in high demand, such as mobile health, big data, robotics, and artificial intelligence. As mobile health continues to become more ubiquitous, digital and mobile health solutions are becoming increasingly important to traditional medical device companies as investment, partnership, and acquisition targets.

Patents Attract Funding

A strategic patent portfolio protects a company’s core technology, which in turn helps secure funding and establishes a competitive market advantage. A recent study found a startup has about a 2.5 times greater chance of achieving success within 10 years of VC investment if it holds patents before the investment.

Patents are extremely important for medtech companies in all stages. For early-stage companies, patents are often the only way for investors to place a value on a company’s technology before regulatory approval. In this way, patents make up a significantly greater portion of enterprise value for early-stage medtech firms than for other startups. As a company grows, patents become the currency to secure financing through venture capital or private equity investment. Patents can also lead to collaborations, joint ventures, and licenses with strategic partners.

For early-stage medtech companies, the key is to develop a strategic patent portfolio that has comprehensive patent coverage around its innovations. The core technology must have adequate patent protection to provide flexibility and room to operate in a desirable market. Companies should file one or a series of patent applications providing the broadest possible patent protection to cover the company’s core technology. To obtain broad patent protection, a medtech company should consider both current and future business objectives and contemplate ways that competitors may attempt to design around its patents.

Tips to Attract Investment

Emerging medtech firms that have developed value-driven patent portfolios can maximize opportunities for investment and partnering deals. Besides building a strategic patent portfolio, early-stage medtech companies should consider the following tips to become attractive targets for investment.

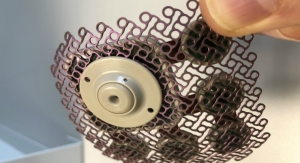

Focus on innovation: Early-stage companies can sometimes act as outsourced R&D laboratories for larger players. Investors desire access to next-generation technology that disrupts medtech markets, even if regulatory approval is years away.

Think long-term: Early-stage firms should plan for investment and partnering deals years in advance. Larger medical device companies are concerned about limiting risk and often monitor a product for years to get comfortable with the technology and management team before investing.

Start de-risking on day one: A medtech startup should address its regulatory, intellectual property, and reimbursement strategies from the beginning in lock step with its investment plan and exit strategy.

Show commercial potential: Strong initial sales or adoption in hospitals and clinics demonstrates the commercial potential of a new medical technology.

Medical technology research and development is fraught with challenges, including cost, time, and regulatory hurdles. As many entrepreneurs have learned, starting and growing a medtech company is a time-consuming and difficult process, but with careful planning that includes a strategic patent portfolio, innovators can thrive in the market. Seed stage funding, non-dilutive grants, and investment from strategics can help medtech companies cross the funding “valley of death” until the right time for VC investment.

References

David J. Dykeman, a registered patent attorney with over 20 years of experience in patent and intellectual property law, is co-chair of Greenberg Traurig’s global Life Sciences & Medical Technology Group. He can be reached at dykemand@gtlaw.com or at (617) 310-6009.

According to a MoneyTree report from PricewaterhouseCoopers and CB Insights, venture capital (VC) firms invested more than $2.9 billion in medical device companies in 2018, a slight increase from the $2.8 billion raised in 2017. Despite the modest uptick, the bar for new investments has been raised. Many VCs are waiting to invest until a device achieves sufficient safety and efficacy evidence, or until regulatory approval and reimbursement have been secured. In fact, over the last two years, 78 percent of medtech VC investment has gone to later stage deals (Series B+), with many companies raising commercialization rounds after FDA approval.1 In 2018, ophthalmology and neurology devices each had four VC deals valued over $150 million. The neurology deals were Series D or later, and six of the eight deals were commercial stage.1

Faced with this financing challenge, early-stage medtech companies need to get creative and cast their nets widely for new sources of funding. Non-VC sources of financing are gaining popularity and providing medtech entrepreneurs with more choices than previously available.

Seed Investments Can Help Launch a Startup

Seed investment from angel investors, incubators, and accelerators can help startups move from an idea to proof of concept, and in the process, begin to de-risk the technology. Seed investment can reduce the amount future investors might need to invest to move new products through FDA approval and commercialization. Seed stage investment often takes the form of convertible notes or interest-bearing loans.

Seek Non-Dilutive Funding

Non-dilutive funding includes grants, awards, prizes, or contracts that do not require giving up any equity in the company. Sources of non-dilutive funding include the government, nonprofit entities, or charitable foundations.

Government Grants: Various federal government agencies award grants and/or contracts to support medtech research and development, including the National Institutes of Health, National Science Foundation, Department of Defense, and Department of Energy. Some grants are awarded for groundbreaking science, while many federally funded research grants are directed toward specific diseases, organs, or stages of life. State agencies often give grants to companies located in economic development zones or that move to the state. One challenge with government grants is that startups need capital quickly, while government grant cycles move slowly, often taking six to 12 months.2

America’s Seed Fund: The Small Business Innovation Research Program (SBIR) and the Small Business Technology Transfer Program (STTR), known as “America’s Seed Fund,” are the world’s largest source of non-dilutive, early-stage seed capital. Nearly 5,000 small businesses receive more than $2.5 billion in U.S. federal government grants and contracts to help them conduct the R&D needed to develop and bring high-tech products to market through the SBIR. Sponsored by various government agencies, SBIR grants can help bridge the period between the end of federally funded research and early-stage investment from angel or seed investors. SBIR eligibility requirements are straightforward—the business must be for-profit, have less than 500 employees, be independently owned, located principally in the U.S., and the principal researcher must be a company employee.

Disease Foundations: Nonprofit disease foundations harness the collective power of the public, private, and academic sectors, fostering collaborations and serving as incubators. Disease foundations can move rapidly and have the flexibility to fund high-risk pilot studies outside the industry roadmap. Disease foundations can inspire follow-on funding from the government, incentivize larger companies to partner sooner, and engage experts with extensive experience in the regulatory process to create a well-defined strategy toward FDA approval. Disease foundations can provide philanthropic support for additional clinical trials and data collection to ensure that FDA-approved treatment options are covered by insurance companies and become broadly available to patients. The investment is also non-dilutive, since foundations typically do not take equity in the startup.

Increased Corporate VC Interest

The last decade has seen a dramatic rise in large medtech and life science companies creating venture funds to invest in promising early-stage medical technologies that align with industry giants. These company-based investment funds have stepped in to fill the funding gap and help early-stage medtech companies cross the valley of death. In the last few years, large medical companies have been competing in the race to acquire private medical device companies in the neurological, surgical, orthopedic, and cardiovascular spaces.

Some recent examples of strategic investments by major players in early-stage companies include:

- Third Pole Therapeutics, a company developing and delivering cardio-pulmonary therapies, announced a collaboration in March (2019) with Actelion Pharmaceuticals Ltd., a Janssen pharmaceutical company of Johnson & Johnson. The collaboration combines the resources and expertise of one of the largest and most respected healthcare companies to Third Pole’s platform technology, capable of expanding access to potentially lifesaving inhaled nitric oxide (iNO) therapy worldwide.3

- In May 2019, Techsomed, an Israeli developer of ultrasound-based monitoring systems for thermal ablation procedures, raised $2.6 million—led by Johnson & Johnson Innovation—for obtaining regulatory approval of BioTrace, Techsomed’s real-time predictive imaging system for thermal ablation.4

- In August 2018, Boston Scientific Corp. acquired Veniti Inc., which developed the Vici Venous Stent System for treating venous obstructive disease. In 2016, Boston Scientific invested in Veniti for 25 percent ownership. The transaction price for the remaining ownership stake included $108 million up-front cash, and up to $52 million in payments contingent upon FDA approval.5

- In March 2018, Pear Therapeutics inked a deal with Novartis to develop digital therapeutics for multiple sclerosis and schizophrenia.6 In January this year, Novartis participated in a $64 million Series C financing of Pear, led by investment firm Temasek.7

In addition to traditional sectors such as cardiovascular and orthopedics, medtech investments are being driven by new technologies in high demand, such as mobile health, big data, robotics, and artificial intelligence. As mobile health continues to become more ubiquitous, digital and mobile health solutions are becoming increasingly important to traditional medical device companies as investment, partnership, and acquisition targets.

Patents Attract Funding

A strategic patent portfolio protects a company’s core technology, which in turn helps secure funding and establishes a competitive market advantage. A recent study found a startup has about a 2.5 times greater chance of achieving success within 10 years of VC investment if it holds patents before the investment.

Patents are extremely important for medtech companies in all stages. For early-stage companies, patents are often the only way for investors to place a value on a company’s technology before regulatory approval. In this way, patents make up a significantly greater portion of enterprise value for early-stage medtech firms than for other startups. As a company grows, patents become the currency to secure financing through venture capital or private equity investment. Patents can also lead to collaborations, joint ventures, and licenses with strategic partners.

For early-stage medtech companies, the key is to develop a strategic patent portfolio that has comprehensive patent coverage around its innovations. The core technology must have adequate patent protection to provide flexibility and room to operate in a desirable market. Companies should file one or a series of patent applications providing the broadest possible patent protection to cover the company’s core technology. To obtain broad patent protection, a medtech company should consider both current and future business objectives and contemplate ways that competitors may attempt to design around its patents.

Tips to Attract Investment

Emerging medtech firms that have developed value-driven patent portfolios can maximize opportunities for investment and partnering deals. Besides building a strategic patent portfolio, early-stage medtech companies should consider the following tips to become attractive targets for investment.

Focus on innovation: Early-stage companies can sometimes act as outsourced R&D laboratories for larger players. Investors desire access to next-generation technology that disrupts medtech markets, even if regulatory approval is years away.

Think long-term: Early-stage firms should plan for investment and partnering deals years in advance. Larger medical device companies are concerned about limiting risk and often monitor a product for years to get comfortable with the technology and management team before investing.

Start de-risking on day one: A medtech startup should address its regulatory, intellectual property, and reimbursement strategies from the beginning in lock step with its investment plan and exit strategy.

Show commercial potential: Strong initial sales or adoption in hospitals and clinics demonstrates the commercial potential of a new medical technology.

Medical technology research and development is fraught with challenges, including cost, time, and regulatory hurdles. As many entrepreneurs have learned, starting and growing a medtech company is a time-consuming and difficult process, but with careful planning that includes a strategic patent portfolio, innovators can thrive in the market. Seed stage funding, non-dilutive grants, and investment from strategics can help medtech companies cross the funding “valley of death” until the right time for VC investment.

References

- http://bit.ly/mpo190750 [PDF]

- http://bit.ly/mpo190751

- http://bit.ly/mpo190752

- http://bit.ly/mpo190753

- http://bit.ly/mpo190754

- http://bit.ly/mpo190755

- http://bit.ly/mpo190756

David J. Dykeman, a registered patent attorney with over 20 years of experience in patent and intellectual property law, is co-chair of Greenberg Traurig’s global Life Sciences & Medical Technology Group. He can be reached at dykemand@gtlaw.com or at (617) 310-6009.